Reputable outsourced accounting firms prioritize data security and the protection of sensitive financial information. Many companies that offer outsourced accounting utilize cloud technology platforms that provide the highest levels of security available in the industry. Cherry Bekaert employs cloud technology platforms, automation tools and machine learning to scale and support your company’s growth. With state-of-the-art software and compliance expertise, external accounting companies can provide peace of mind for businesses that outsource these services. Cherry Bekaert offers outsourced accounting services to businesses that want to reduce costs, improve efficiency and focus on core operations.

- An outsourced CFO that’s experienced in the nonprofit sector might not grasp the financial challenges that a fast-growing technology company deals with.

- You may rest assured that your accounting is in the hands of a reliable and knowledgeable business if you choose an outsourcing provider wisely.

- This is why many companies look into DIY accounting systems such as QuickBooks or Xero.

- For example, if you’re concerned about fraud risk, outsourced accounting services will independently review financials and produce accurate reports to minimize these concerns.

- Get in touch with one of our experts and see how outsourcing can fit into your accounting strategy.

Equally, focus on finding an outsourced CFO that has significant experience navigating the challenges that are currently top of mind for your business. If your main financial goal is to sell your company, make sure you hire an outsourced CFO that has previously advised on a number of successful transactions. Because an outsourced bookkeeper isn’t immersed in your business the same way an internal employee would be, there may be some intricacies outsourced accounting meaning of your business that they don’t understand at first. It’s important to find an outsourced bookkeeping partner that will invest the time required to truly get to know your business. But as your business grows and your financial needs evolve, it’s common to find that your initial approach to bookkeeping is no longer delivering the results you need. If that sounds familiar, you might want to consider outsourced bookkeeping.

Common mistakes people make when outsourcing.

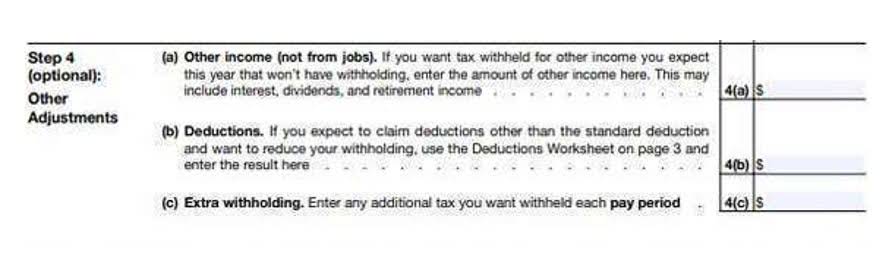

That’s right—payroll taxes aren’t solely the federal government’s domain. As an employer, you’re responsible for half of the FICA tax amounts for each employee. One of the biggest struggles many organizations face is the high level of regulation and compliance.

This scalability ensures that organizations have the necessary accounting support without the burden of hiring and training additional staff or reallocating internal resources. Accounting professionals have the expertise to handle complex accounting tasks, reducing the risk of errors or omissions. Outsourced accounting is when an organization delegates its accounting and financial functions to an external third-party service provider.

Benefits to Outsource Accounting Services

For businesses that may need to meet financial compliance, or that are struggling to hire a capable in-house accountant, outsourcing provides a practical solution. While larger corporations may not always need third-party support, there are also situations where it may be appropriate. For example, if you’re concerned about fraud risk, outsourced accounting services will independently review financials and produce accurate reports to minimize these concerns. Among all the benefits of outsourced accounting, the most attractive advantage is that it can give your internal team more time to focus on other matters. For example, if you are unable to hire a full internal accounting team, your outsourced provider can assume those responsibilities to save your company time and money.

- Outsourcing accounting and financial services can also help companies meet specific accounting and financial needs for situations as they arise.

- SecurityMany business owners are reluctant to use outsourced accounting services because they are concerned about the security of their accounting data.

- You’ve scoured the internet for blogs about outsourcing and you’ve consumed enough pertinent information to make a well-thought-out decision.

- Challenges in working with an outsourced controller typically occur when communication is infrequent.

- Outsourced controllers also bring a tried and tested approach to helping manage your business’s finances.

- Think about the encryption method providers employ on their websites and the security steps to monitor location and data.

- As one of today’s leading solves for the growing pains of practices from small to large, ‘outsourcing’ is a word that has become closely linked to the modern accounting firm.

If you’re self-employed, however, you’ll need to pay the full 15.3% of FICA taxes due on your salary. FUTA taxes are paid entirely by the employer; there is no employee payment. The revenues from payroll taxes are used to fund public programs; as such, the funds collected go directly to those programs instead of the Internal Revenue Service (IRS). By outsourcing your accounting, you can save money and improve results at the same time. Outsourced accounting, governance, human resources and payroll solutions – under one roof.