He has authored articles since 2000, covering topics such as politics, technology and business. A deferred tax liability or asset is created when there are temporary differences between book tax and actual income tax. Record a prepaid expense in your business financial records and adjust entries as you use the item. On December 31, the company writes an adjusting entry to record the insurance expense that was used up and to reduce the amount that remains prepaid.

- Other operating risks against which an organization can insure its activities include casualty, property, legal liability, credit and life.

- Learn the role of each of these steps and discover examples of this process.

- Location and usage of the vehicle can also affect the premium, as well as the gender, age, and marital status of the drivers.

- To complete the entry from the previous example, credit $35 to the interest income account.

- During the month you will use some of this rent, but you will wait until the end of the month to account for what has expired.

- As each month passes, the Accumulated Depreciation account balance increases and, therefore, the book value decreases.

- A small cloud-based software business borrows $5000 on December 15, 2017 to buy new computer equipment.

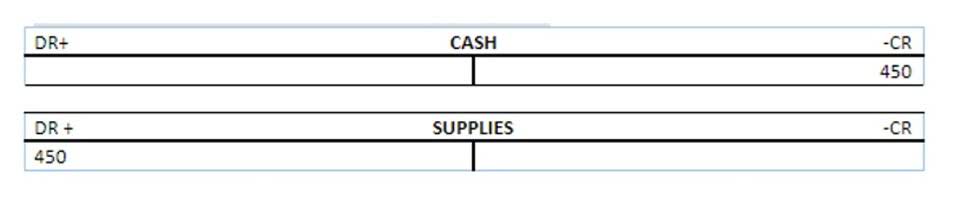

Insurance expense is the cost a company pays to get an insurance contract, as well as any unpaid monthly premium costs on the insurance contracts. On the other hand, liabilities, equity, and revenue are increased by credits and decreased by debits. Marquis Codjia is a New York-based freelance writer, investor and banker.

What is Interest Expense?

In other words, the insurance premium is paid before it is actually incurred. Prepaid insurance is a future expense, which you must pay upfront and receive its benefits over time. However, once you make the premium payment, the policy’s coverage becomes an asset, which diminishes over time during the coverage period. The journal entry is debiting insurance expense $ 1,000 and credit unexpired insurance $ 1,000. The unexpired insurance will reduce from balance sheet and increase the insurance expense on income statement. The journal entry is debiting unexpired insurance and credit cash payment.

It may also be time to look at your business plan and make sure it can accommodate rate increases. Otherwise, staying profitable and growing your business could prove challenging. Interest expense is important because if it’s too high it can significantly cut into a company’s profits. Increases in interest rates can hurt businesses, especially ones with multiple or larger loans.

How Do You Find Interest Expense in Accounting?

The word “expense” implies that the rent will expire, or be used up, within the month. An expense is a cost of doing business, and it cost $1,000 in rent this month to run the business. The word “expense” implies that the insurance will expire, or be used up, within the month.

- Since the service was performed at the same time as the cash was received, the revenue account Service Revenues is credited, thus increasing its account balance.

- The deductible is the minimum amount a policy holder is required to pay towards the financial loss before the company will begin to absorb the additional value of the loss.

- When submitting an insurance claim, it is important to review the coverage and policy details to ensure accuracy and to maximize the chance of successful reimbursement.

- Read more, and selling and distribution expenses are the three types of indirect expenses.

- While prepayment and monthly billing are standard ways to pay an insurance premium, some auto insurance companies offer pay-per-mile policies.

- Insurance becomes an asset when you experience a risk covered in your insurance plan, which activates your coverage, allowing you to make a claim and receive a successful payout.

This annual fee can be paid with a one-off payment or it can be spread over 12 monthly payments, or sometimes fortnightly. An insurance expense occurs after a small business signs up with an insurance provider to receive protection cover. There are various types of insurance is insurance expense a debit or credit cover available to small businesses and business owners so we’ll have a look at those and how best to treat them in the accounts. So when it comes to entering these transactions into the bookkeeping records of a business there are different journal entries to consider.

Types of Insurance Expenses

It is the accounting principle that revenue and expense must record based on occurrence. For insurance, the expense is recorded when the company has utilized the service. The reverse of unexpired insurance will be made based on the consumption to ensure the expense is recorded properly. When the company pays for the insurance, it is not yet recorded as an expense. Unexpired insurance (also known as prepaid insurance) is the amount of insurance that company pays to the insurance company in advance which is not yet fully consumed.

This journal would be used if your business has paid or will be paying a contractor to repair something. The above journal uses the Other Income account to show it is not part of the normal day to day activity income earned by the business. Accountingcoach.com has a good example of accounting for payroll withholdings for health insurance. Your individual vehicle insurance may not cover your business use of your personal vehicle.

Some types of asset accounts are classified as current assets, including cash accounts, accounts receivable, and inventory. These include things like property, plant, equipment, and holdings of long-term bonds. The dual entries of double-entry accounting are what allow a company’s books to be balanced, demonstrating net income, assets, and liabilities. With the single-entry method, the income statement is usually only updated once a year.

I am sure if the Accountant wants to change anything, adjusting journals can be done. But in the meantime, these entries will keep the books looking good. Something to keep in mind is if these two entries are in different months. The example is a bill of $1,000 for General Liability insurance and then two payments of $84.